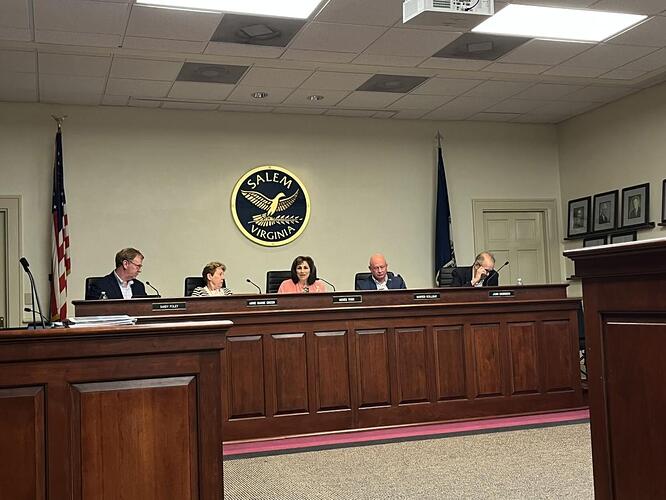

Upon second reading Monday, the Salem City Council approved its fiscal year 2025-26 budget.

Included in the total $244.55 million budget is a more than $400,000 increase for the city’s school division. Salem City Schools worked into its budget a pay increase of around 4% for all of its eligible full-time employees. City employees will receive a cost of living adjustment of up to 4%, according to city documents.

At its May 12 meeting, the council lowered the real estate tax rate by 2 cents, bringing it to $1.18 per $100 of assessed valuation for the fiscal year starting July 1.

Following its most recent real estate reassessment, however, the city calculated that there would be an effective tax rate increase of 6.47%. Without lowering the real estate tax rate, the increase would have worked out to be 8.28%.

The city’s budget shows $617,500 for “immediate capital needs” at the Salem Civic Center. The civic center was at the center of many discussions during the most recent city council election. Many of the candidates expressed that the civic center needs repairs. Coming up with a plan for what to do with the civic center moving forward was also discussed during campaigning.

People are also reading…

- North Cross grad Kyle Fraser wins ‘Survivor’

- Attentiveness and being a priority led North Cross CB Jaziel Hart to commit to Penn State

- Harm reduction a major factor in decreased overdose deaths, officials say

- Grants eyed to restore historic Washington Park cottage

The personal property tax rate in Salem for fiscal year 2025-26 is $3.40 per $100 of assessed value, and the machinery and tools tax rate is $3.20 per.